03 October 2023

When SILK Laser Clinics, co-founded by UniSA alumnus Martin Perelman, was listed on the ASX, the business was hailed as an overnight success story. In reality, it’s been a 15-year journey from a garage start-up to a reported $180 million buyout by Wesfarmers.

Martin Perelman

Founder and Managing Director of SILK Laser Clinics

Bachelor of Management (International Business)

In 2009 Martin Perelman and three friends saw a business opportunity and took the plunge. “We each put in $50,000 – I didn’t have $50,000,” says Martin, who scraped his share together, confident that at 30, he’d still have a chance to recoup any losses.

At the time, Martin was working in the Swiss watch industry, living in Sydney and sharing a house with a friend who had a job servicing and repairing cosmetic lasers. The plan was to purchase two second-hand lasers, repair them in their garage and establish a laser hair removal and skincare clinic. “It was pretty basic, but it was a good business plan.”

Calling on friends and family for interior design, branding and fit-out, the first SILK Laser Clinic opened in Martin’s hometown of Adelaide in 2009. “I still remember, in our third or fourth week, we did more than $10,000 in sales! We were working it out as we went; we didn't understand BAS and P&L; we hired a bookkeeper from the Yellow Pages.”

All of this took place as a side hustle for Martin, who was still working at his day job and on SILK after hours It wasn’t until 2014 when Martin returned to Adelaide with his wife and young family that he joined the business full-time.

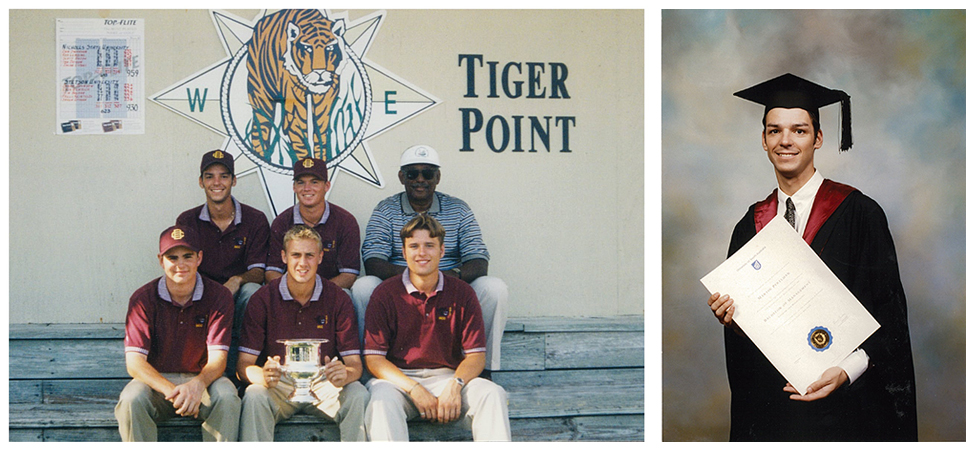

Martin credits his love of golf with teaching him to work hard and follow methodology. Having played for the state, he won a scholarship to college in Florida and later transferred his studies in International Business to UniSA. “My degree really helped me set up my initial business foundations as I went from my golfing life into my first job in the business world. I think my dedication to golf and my degree was a great combination for what was to come. I continue to adopt that same philosophy, and I think that's probably one of the reasons why my team have believed in me – I’m told that my work ethic is infectious.”

The partners continued to open new stores, but there were price pressures in the market, and they knew they had to diversify while remaining specialists. “We wanted to move into more repeatable revenue, such as injectables and skin treatments where you come in every few months.”

Eventually, Martin’s partners exited the business, and to ensure continued growth, he brought on private equity investment. In 2018, Advent Partners took a majority share with a vision of growing the number of stores from 12 to 60. SILK was now considered a healthcare business.

COVID-19 presented SILK with arguably their best trading period as clients emerged from lockdown, perhaps more self-conscious thanks to working online, but also more inclined to indulge in some non-discretionary self-care. “It's part of their everyday routine, and it's something that they won't really sacrifice.”

In mid-2020, the board decided to list on the Australian Stock Exchange. “Taking SILK public was probably one of the most amazing, exhausting and humbling experiences, all at once,” says Martin.

“Going from an operational CEO to almost investor-facing was an interesting learning curve. You really need to understand what sort of management team you need around you to help drive your vision. Make sure that your management team believe in your vision and your journey – make sure they are on their journey with you. You’re either on the bus, or you're off the bus.”

Martin is aware of the pitfalls of founder-led businesses. “Everyone that's invested in SILK hasn't invested because they want to be in cosmetics; they've invested in the management and the founder.” As such, he encourages his senior managers to be responsible for their units. “I want all these people to be wealthy and successful because they're the key to the success, the future. They all drive their careers.”

As SILK moves into the next phase of ownership, as a key part of the cosmetic offering in the newly formed Wesfarmers Health division, Martin will no longer have a stake in the company. However, it’s important to him that he locks in his management team.

“I think it's really exciting for some of the guys here and in our office in Sydney to move up from GM or AGM roles into C-suite. It’s a great opportunity to retain them in our business as they see their next career progression.”

And what does the future hold for Martin? “I am looking forward to the next chapter of my life whenever that arrives. I feel my skill set has become quite broad, based on my experience at SILK. We started with a single clinic and then have gone through multiple investments with high net worths, private equity, and then listing on the ASX. We have then come full circle to come back off the ASX and acquired by one of Australia's largest companies, Wesfarmers.”

Martin is a proponent of self-belief and a good work ethic as the keys to success. “This country is built on entrepreneurial business, so don't let fear get in the way of having a crack at something. You can get great people around you, but you must be the leader and drive the strategy. That vision is critical. There's no way we would be where we are today without a great chairman, who's a mentor to me, a good board, and people with great skill sets, which I didn't realise I needed when I hired them – now I can't live without them.”