The floor is uneven, and it is hard not to slip and disturb the quietude of so many tiny layers of dust. Specks float upwards, dancing in the light in front of a forlorn stage. Themed restaurant. Nightclub. Dutch club. Warehouse. Busted-up little palace of dreams.

Welcome to the Night Train building, the future home for enterprise at the university at which I work. It's a faded little hand me down, and impossible not to love it after such a brutal 2020.

At first glance, our moment seems as slippery and busted up as the Night Train. There is no quietude for the tens of thousands of people who have lost their jobs since the planes have fallen silent, or for those experiencing the unbearable agony of losing loved ones.

The best response appears to be to gather up the shards of this moment and re-build better what matters most: our community and the economy. We have seen this in the rollout of multiple vaccines, but research in the broader has also been at work addressing the deep and broad social and economic impacts of COVID.

This has not been a broadcast mission, for the best ideas take flight in partnership. More importantly, it is not a singular, static mission: the best universities shapeshift with their communities, in partnership.

Some of our partners hark back to the first life of the Night Train: a proud Goldsborough Mort warehouse. It pushed wool bales into a global circular economy in which we—the pink bits of the world—were producer and someone else was manufacturer.

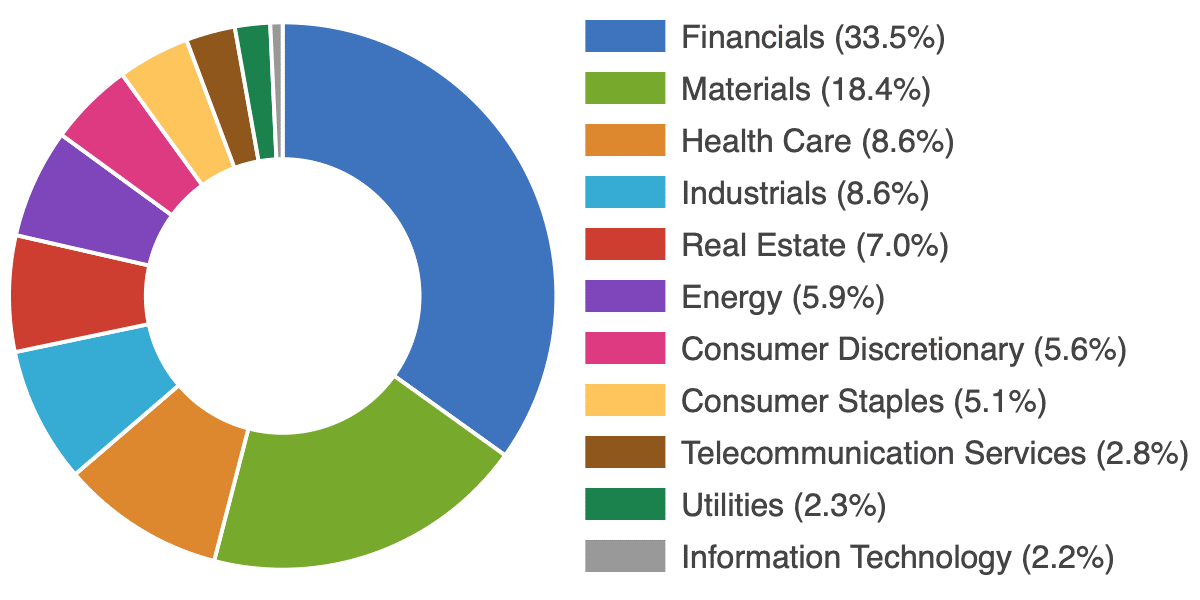

Some people are sceptical about whether we can break from this old circular economy. If you look at the Australian Stock Exchange listings—the ASX—they appear to have a point. Over 20 companies on the Australian Securities Exchange ASX100 date from the nineteenth century, and most were founded by the middle of the twentieth century. As this chart from the ASX shows, this legacy is one of financials, materials—mining—and energy, which make up 60% of the list. IT companies account for just 2.2%.

Run down to the ASX200 and the top three sectors shift to just under 50% of the list, but IT rises only to 3.5%. Switch over to companies that have listed in the last six months, and financials still dominate in the form of ETFs: investment fund types for a range of asset classes.

If you hop over to the US-derived NASDAQ100, the story appears to looks quite different. Most of the companies were founded in the 1970s and 1980s, when the Night Train building took on its second to fourth lives as a Dutch club, nightclub and themed restaurant. Tech firms Apple, Microsoft, Amazon, Google, Facebook dominate the NASDAQ in the same way that financial, mining and energy activities dominate our local listings.

It is tempting to see us as still on the producer side of a global circular economy in which manufacturing and innovation are happening elsewhere. Indeed, you might even think that we were out dancing and partying when these shifts happened, and that our vulnerabilities are coming home to roost in a busted-up economy of dreams.

Businesses, like buildings, though, have complex lives. They are rarely one premise, and rarely one economic sector. Their functions and activities wax and wane. They scale, aggregate functions, fold down and spin parts out. Financial firms are playing a key part in security innovations for example; and logistics and digital twins are important elements in energy work.

New parts of our economy are growing under old structures and appreciating this is critical to the health of university-industry partnerships. The nine space startups we hosted in 2020, for example, are kicking goals in partnership with defence and materials giants. They aren’t fighting those giants; they are working with them and driving innovations in the everyday as well as near space. Ping uses novel approaches to acoustic monitoring to detect damage on wind turbine blades; Lux Aerobot uses atmospheric satellites to produce high-resolution images for a range of applications. Our economy is new-old in ways that defy simple categorisations.

Partnerships are also dynamic and powerful in other ways that defy the idea of us being stuck in the nineteenth century. While an industry partnership might start with one part of a university or be anchored there, it rarely stays there. Most importantly, partnerships cross education and research. This is our most powerful translational spectrum, and community and businesses expect us to play its full length, without the portfolio metatags and largely introspective debates on the categories of a research-teaching nexus. We need to speak and act in the name of both—and across all of our disciplines—seamlessly.

So we are working to accelerate enterprise in South Australia—a state that is already kicking innovation goals—through our new Enterprise Hub. This is an outside in, one stop-shop for creating and sustaining partnerships. It is powerful statement about the value of stewardship in tough times. Stewardship means generously expecting to be taught, as well as to teach, and acting from integrity in the sense of our activities being wholistic, and for good. Stewardship will connect our actions, our digital footprint, and a reactivated Night Train building.

Over the coming year, I’ll tell the story of our Enterprise Hub, and of the power of the partnerships that are helping us to accelerate the rejuvenation of our economy, and society, for good.

Professor Marnie Hughes-Warrington AO is the strategic and operational leader across research activities at the University of South Australia. Her role is to design and deliver approaches that help staff and research students alike to engage with industry, government and community to deliver novel and transformational solutions to problems, and to change the ways that we think about the world.